How to Manage Your Credit Score

Optimize Your Credit

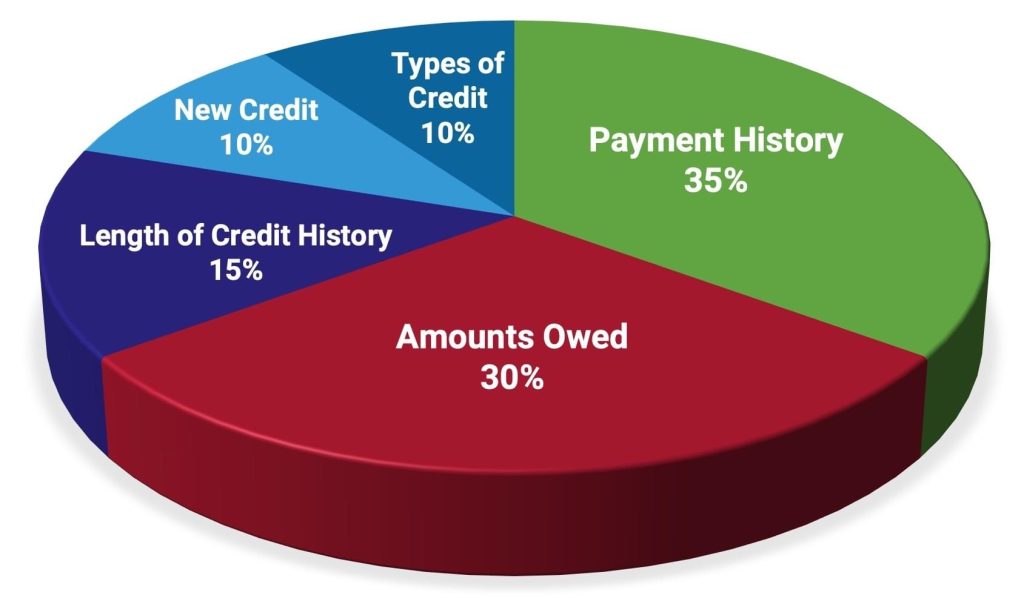

Your Credit Score Breakdown:

Credit Reporting Agencies:

Check out a transcript of this video below:

Hey, Keyspire, Jason Witzell here, Success Coach. Over the years of coaching, I’ve had students raise concerns about their credit score taking a hit when they go through their preapproval process. For an income property. Of course, you should always be concerned about a drop in your credit score.

But let me explain why in this case, there’s nothing to worry about. Number one, it’s necessary if you’re applying for credit. If you’re getting you wanna get pre-approved for the purchase of an income property, then they’re going to pull your credit score. But number two, it doesn’t impact your score significantly.

So it’ll drop about seven to 10 points. It’s only temporary. It’ll come right back up. To where it was. So unless you are working with a number of mortgage brokers or going from bank to bank which I don’t recommend you do, then yeah, it’s gonna have an impact on your credit score. So what’s important is that you understand the factors that influence your credit, and that’s the key to managing your credit score and also building your credit.

Until next time, Keyspire, take care.

Recent Blogs

The Rockefeller Method: How Canadian Families Can Build Wealth That Lasts Generation

What if you could structure your finances like one of the wealthiest families in history—without needing Rockefeller-level wealth to do…

From Confusion to Clarity: The 5 Steps to Confident Real Estate Investing

You’re ambitious. You’re driven. You’re juggling a busy career, maybe a family, and you know you should be making your…

Upsizing Smart: Turn A Single-Family Home Into A Duplex (And Use Your Equity To Buy Your Next Property)

By Harris Newman, Mortgage Agent L2 – EZ Mortgage Solutions Why “Upsize” Now? If you love your neighbourhood but need…

The 6 Timeless Principles Every Successful Real Estate Investor Follows

SPONSORED CONTENT: Referral Network Realty Referral Network Realty is extremely grateful to have been partnered with Keyspire for over a…