How to Manage Your Credit Score

Optimize Your Credit

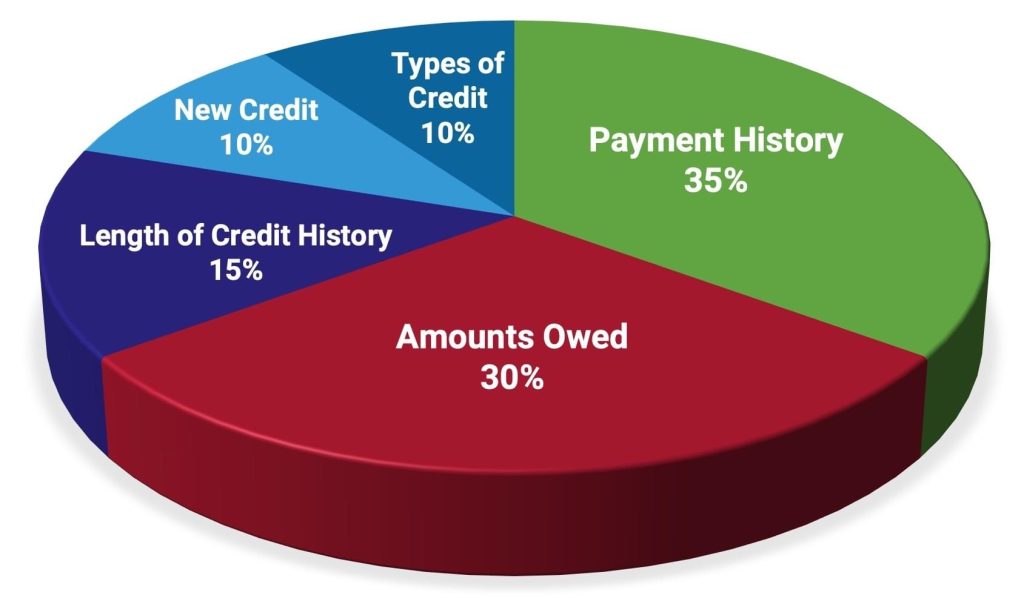

Your Credit Score Breakdown:

Credit Reporting Agencies:

Check out a transcript of this video below:

Hey, Keyspire, Jason Witzell here, Success Coach. Over the years of coaching, I’ve had students raise concerns about their credit score taking a hit when they go through their preapproval process. For an income property. Of course, you should always be concerned about a drop in your credit score.

But let me explain why in this case, there’s nothing to worry about. Number one, it’s necessary if you’re applying for credit. If you’re getting you wanna get pre-approved for the purchase of an income property, then they’re going to pull your credit score. But number two, it doesn’t impact your score significantly.

So it’ll drop about seven to 10 points. It’s only temporary. It’ll come right back up. To where it was. So unless you are working with a number of mortgage brokers or going from bank to bank which I don’t recommend you do, then yeah, it’s gonna have an impact on your credit score. So what’s important is that you understand the factors that influence your credit, and that’s the key to managing your credit score and also building your credit.

Until next time, Keyspire, take care.

Recent Blogs

Two Powerful Ways to Grow Your Real Estate Portfolio in 2025

By Harris Newman, Mortgage Agent (L2) – TMG The Mortgage Group Creating Mortgage Solutions “EZ” Coast to Coast (1) CMHC MLI SELECT – The 2025 Investor’s Advantage If…

Revolutionary New Construction for Investors

Sponsored Content: Revolutionary New Construction for Investors The Self Funding House® (TSFH) has created opportunity for investors with a timely new construction product,…

Unlock the Multi-Trillion Dollar Secret

SPONSORED POST: Unlock the Multi-Trillion Dollar Secret: How Registered Funds Can Fuel Your Real Estate Projects Did you know there’s…

The Importance of Taking a Multi-Year View when Investing in Real Estate

Greybrook and our investors have been deploying equity in large scale real estate opportunities across the GTA, southern Ontario, and…