Earning Money with Passive Appreciation

When I purchase I property, in most cases my exit strategy is Buy and Hold.

Now I was purchasing quite a few properties at a time when Flipping became very popular. I was always asked by my peers, “Michael, why aren’t you renovating and selling, why are you just holding onto this property?”

The answer is simple….Passive Appreciation.

I want to take some time and focus on a specific strategy: Buy and Hold, Passive Approach.

In the video below, I am going to walk you through an example using this strategy to calculate the annualized Return on Investment (ROI).

It’s important to calculate the Total ROI before purchasing a property to decide whether this investment will have the greatest return on your money. Do the math – the answer is always in your numbers!

With this strategy, you’re purchasing a property and holding it for several years. You would then refinance to pull out some of the equity.

Hint: This is a great strategy to use when purchasing a turnkey income property.

Check out the transcription of this video below!

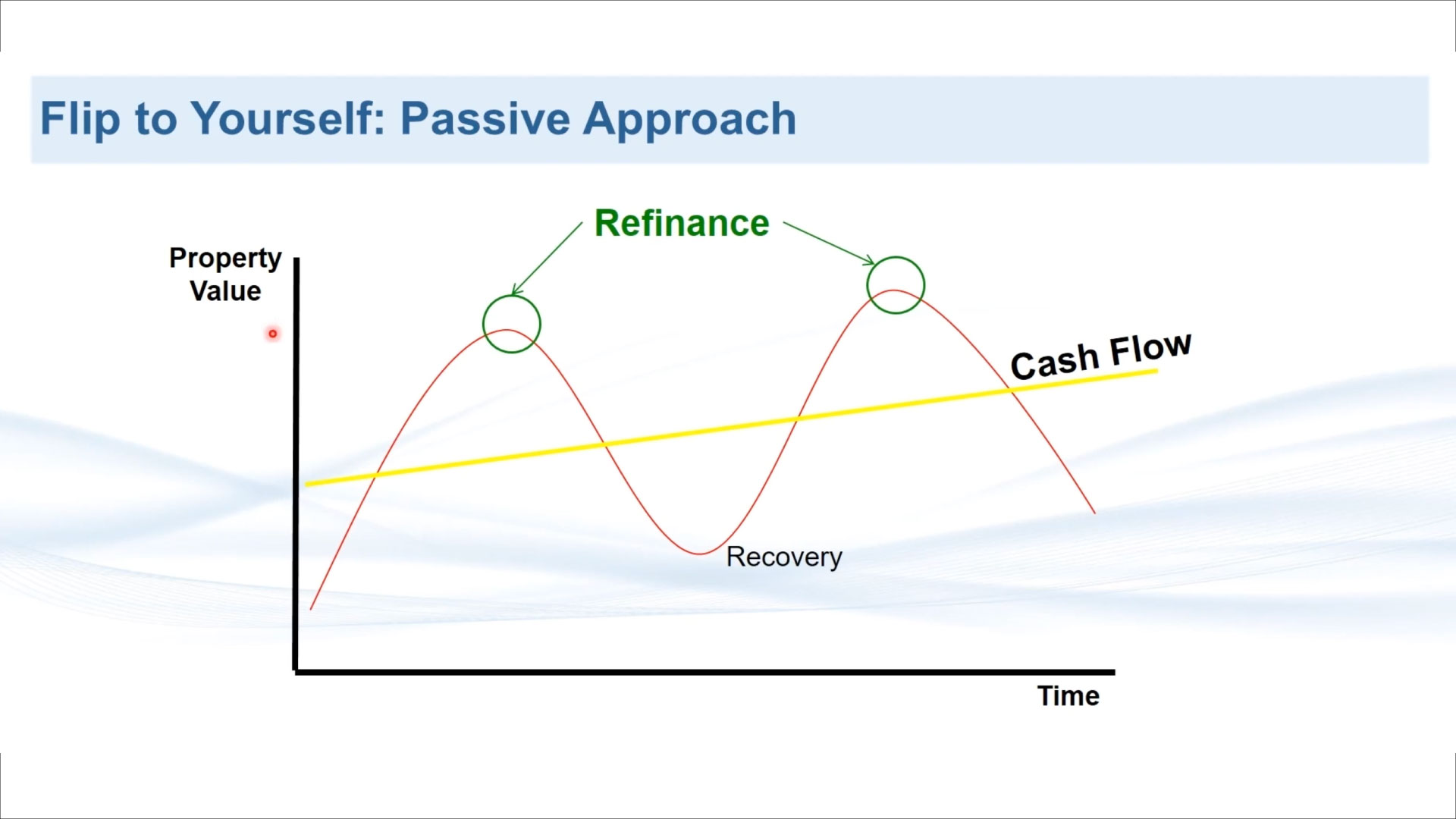

This is the graph where we’re going to refinance somewhere along the peaks. Okay? So say we purchase a property, somewhere around here. Pull up my pen… say we purchased the property somewhere around here, and then we’re going to refinance it, we’re going to go through the market cycle, cashflow the whole time, and we’re going to refinance it up here.

All right. This is the passive approach. We’re going to wait for the market to get to a point where it’s of greater value than when we purchased it, which would be, you know, right around here. All right. You want the value to be higher.

So what do the numbers look like? So here’s the deal details. Now as we go through these examples and deal details, it’s important for you to know that this is the model and the outline, so you can insert any deal details that work for you.

And certainly when you’re building your portfolio, you’re going to put in the deal details that work for you.

So here we go, we get to $350,000 property. We’re going to put 20% down. 30 year amortization. The term of the mortgage will be five years. Our interest rate is, let’s say 4%, market appreciation rate 3%. And the time horizon is five years.

So we know our exit strategy is five years. We’ve strategically set our financing to match our exit strategy. Beautiful. I’m happy with this.

If our exit strategy was to hold it for three years, then we wouldn’t want, um, we could get a five-year term on a mortgage, but we wouldn’t want a five-year closed mortgage.

Cause then we’re going to pay heavy penalties. So we may want a three year mortgage or a three three-year closed mortgage, even. That way we get a bit of a lower interest rate, but we’re not locking ourselves into keeping that property, keeping that mortgage after three years.

So the takeaway is always sync up your financing, your corporate structure, sync up all of these things with your exit strategy. It’s critical you know your exit strategy upfront.

So let’s pull back up our chart that we remember from our Buy and Hold course. This is the passive approach. So we’re going to measure the market value. Okay, we’ve got years zero to five on the left. We’re going to fill in the market value, the mortgage amount, as it changes every year, and then our Four Ways to Win, which we always anchor to our cashflow principle recapture, passive appreciation and active appreciation.

So let’s take a look. On year zero we purchased the property. It’s worth 350,000. The mortgage amount is for 280,000. Why? Because we put 20% down. So the mortgage is automatically only 280,000 and we’ve accumulated none of the Four Ways to Win because we have just purchased the property.

The question of where do we find, how do I calculate Michael? How do I calculate the principal recapture and the mortgage amount? Well, very simple. You’re just going to go to your software and you’re going to go to the end of the first year, which is month 12 and the beginning of the second year, which is month 13.

And our principal recapture. Cumulative principle sits right here. $4,959.16. That’s how much principal recapture we’ve paid down over 12 months. And then our beginning balance at the end of, at the 13 month, which is the first month of the next year, is $275,040.84. Okay. So that’s how we calculate it is we use our software.

We use the tools that Keyspire has provided in order to run this business. And here’s a great example of that. All right. So we’re going to, we’re going to calculate that. You can see on the left here, we’ve put in all the deal details that I’ve given you. $280,000 loan amount, 4% interest rate, monthly payments. A 30-year amortization period.

And then we’ve just put, start and end date, start and end date for this example are not important. It’s just all of the details. Our payment amount is also here and that’ll show up a little bit later in this session.

We also know that as we go through the years, the amount of interest we pay decreases.

And the amount of principal we pay increases. So the least profitable year to own an income property is the first year. And you’re going to see, as I pull up the next chart is that every year we pay down more principal, so the property gets more profitable every single year and more of the mortgage gets paid down.

And we can see that right here. Our principal recapture after year two is $5,159. We could find that in our software at month 24, and then we have our mortgage amount, $269,881. We can also find that in our software at month 25. What should it be the first month of the next year, the third year.

And you’ll follow that methodology to be able to fill out this chart. Passive appreciation, $10,815 is 3% of the market value, $360 and we go on and we continue to fill out the chart with that same methodology to get down to the numbers of our fifth year. So at the end of five years, the market value is $405 and the mortgage has been paid down to $253.

Okay? Now these two numbers are extremely important because the spread between these two numbers is what we call the equity that we have in this property. This is the equity that we’ve built up. Okay? At year zero, when we bought the property, the equity was simply our down payment. But as the years go on after five years, the equity has increased to more than our down payment.

So let’s calculate what that equity is, and how we can actually find out what our available capital is. Okay? Because we can access all this equity. We always have to keep 20% in the property, but we want to take out some of this difference between the 253 and the 405.

So let’s answer the question. How do we calculate, how much of this equity we can access? So we’re going to call that are available capital and here’s the formula. It’s the new market value, which is the 405 times 80% loan to value, because the lender is only going to give you 80% loan to value on the new market value, which means you have to keep 20% in, which is also why we’ve got to put 20% down. Minus the new principal which is the 253. And then we’re going to subtract refinance fees, because you’re going to have to pay a fee to refinance, either with the lawyer or perhaps an appraisal. So there’s some refinance fees here, which will be different for everybody. And we’ve put a placeholder in here for you.

So the number, uh, we’ve used our numbers right from our chart $405,745 times 80% loan to value.

We get that number and then let’s subtract our new principal and our refinance. Okay, we’ve used 500 here. And so the available capital between what the market has gone up, the passive appreciation and principal recapture is $70,978. Now let’s turn that into an ROI. What is the, our return on investment?

And this is a five-year return, remember. Because it’s taken five years to earn this money, and it’s very passive. So I don’t know if I would call it earning the money in the traditional sense, but Hey, that’s real estate, it’s passive investment investing. So five-year return. And now keep in mind, this is only our passive appreciation and our principal recapture.

This does not take into account our cashflow. Okay? So our five-year return on just these two metrics, divided by our capital investment. So our down payment plus our closing costs plus our refinance fees. So that’s how much it, this is what was required to purchase the property. And there’s no renovation fees here notice? Because this is a turnkey property. So there was no renovation to do. So as we populate the numbers, this is our 70,000 from our last slide, 70,978. The three numbers on the bottom here, these come right from our case study slide at the beginning.

So the deal details, 70,000 down payment. $1,200 in closing costs and $500 in refinance fees.

So the math works out to 98.99% over five years. This is our return on investment over five years. So when we look at a five-year return, I always like to break it down annually. Everything needs to be annualized, so you’re comparing apples to apples.

So let’s annualize it by dividing it by. And this gives us a 19.8% annualized ROI on capital.

Recent Blogs

The Best Time To “Cash Out” Is…

“When should I ‘cash out’ and sell my properties?” I hear this question a lot and it blows my…

Attract Higher Paying Tenants by Being Pet Friendly!

Optimizing an investment property is all about maximizing your income and minimizing your workload and expenses, such as tenant turnover.…

The 7-Step JV Process

“It’s better to own 10% of 100 properties than 100% of 1 property.” No matter how wealthy and successful…

Income Vs Net Worth

In today’s world, two of the most important financial metrics are income and net worth. Understanding the distinction between the…