Determine Your Investor Profile

February 9, 2023/

An Investor Profile defines the type of investor you are based your individual circumstances and preferences. Each investor’s profile is unique with a number of factors that influence it.

Factors that Affect your Decision:

Time, Cash Flow & Liquidity

1. Amount of time you have available to execute

2. Amount of investable capital you have

3. Amount of Cash Flow you require

4. How liquid your capital must be

Personal Circumstances & Preferences

1. Skills and experience level

2. Upcoming life changes

3. Risk profile

4. Personal preferences and perceptions

Its always a balance between time and money

Determining your Investor Profile is key to achieving success. Reassess your profile as your portfolio grows and remember, diversification gives your portfolio security.

Your Investor Profile is Unique to YOU!

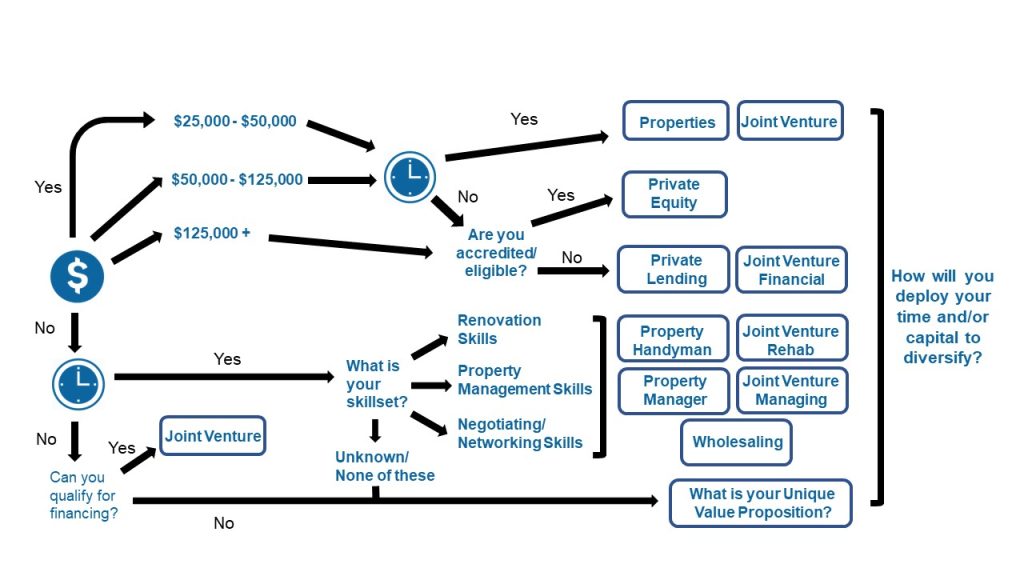

This chart is the map to determining your Investor Profile.

Start at the left and answer the questions to determine what investing strategies are best suited to your time and resources.

If the answer is “Yes” to having available capital, follow across the top of the chart to determine which investing stream is best suited to you.

If you answered “No” to having at least $25,000 in available capital, then you will have to invest your time and skill as a working partner in a joint venture.

If you don’t have money or time available, can you qualify for financing? If so, you may be able to be a qualifying partner in a joint venture.

Recent Blogs

The Best Time To “Cash Out” Is…

“When should I ‘cash out’ and sell my properties?” I hear this question a lot and it blows my…

Attract Higher Paying Tenants by Being Pet Friendly!

Optimizing an investment property is all about maximizing your income and minimizing your workload and expenses, such as tenant turnover.…

The 7-Step JV Process

“It’s better to own 10% of 100 properties than 100% of 1 property.” No matter how wealthy and successful…

Income Vs Net Worth

In today’s world, two of the most important financial metrics are income and net worth. Understanding the distinction between the…