How Much Cash Flow is Enough for You?

February 2, 2023/

Scott and I talk about Cash Flow a lot. We even wrote two books called Cash Flow for Life and Quick Start to Cash Flow.

Cash Flow is a fundamental part of real estate investing, and one of The 4 Ways to Win, but is there a minimum amount of Cash Flow you want to be earning on an investment?

This question was asked on an expert panel I was on.

Check out our answers:

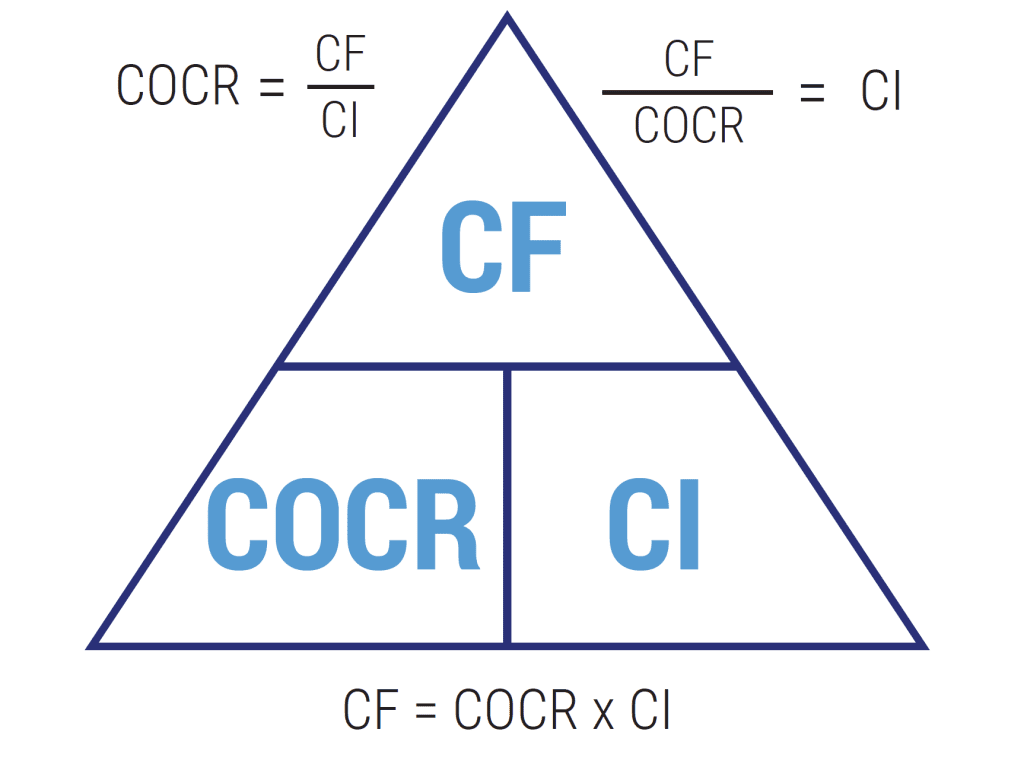

Cash-on-Cash Return (COCR) measures the actual return realized on your cash invested. To calculate your COCR, divide your annual Cash Flow by the total amount of money you have invested in the property.

Check out the transcript for this video below:

On your website, on our member form, website we watched a video where Corey and Tiffany talked about cash flowing and when a property cash flows, what that means and how much a property should cash flow. One of the things you said, Tiff, was a property, I don’t consider a property cash flowing at $200 a month.

So what do each of you consider a property that cash flows or is it like the lawyers and the accountants said it depends, I don’t know?!

Yeah.

Or is there like a benchmark like, it has to cash flow $500 a month or a thousand, or what’s your take on those?

Okay, so the question is what is the minimum cash flow in dollars that you should accept on a property?

And I’ll clarify for me in my market with what I need to put down on the properties that I buy, I wanna see it at least at $200, but that’s actually based on a percentage. And I’m not a percentage person and I’m not a numbers person. But so it’s more how much did you put down versus how much are you getting back on a monthly basis?

Okay.

My market, my product for me, I just know in there it’s gotta be about 200 bucks. A better answer to it would probably be something about math, and I’m not very good at that, so I’m gonna just leave it to them.

True.

That’s, you.

Are you passing it to me, now?

Yeah.

Okay. Yeah. I can’t say anything more than what Tiff just said.

Wow.

Yeah.

Wow. Did everyone… We got that recorded.

I would make sure like $200 is a number that’s always been in my head, but that doesn’t mean that a property that is $50 a month positive cash flow might not, doesn’t work, it might work. It depends on, to me, I look at the long term. What am I gonna get in five years, 10 years off of this property if it’s zero cash flow?

But the equity is going up at a tremendous rate in that market. Then to me, that when we were doing our buying in 2005, 2006 in Edmonton, properties were going up $25,000 a month. Wow. And so did I care about a hundred dollars or whether it was $500 right a month. Cash flow. I didn’t care at. However, after you own 50 or 60 properties and they’re all $100 or $200 negative cash flow…

Yeah.

Then that can kill you.

Yeah.

And so that’s where you have to make sure it has some positive cash flow.

Sure.

And that it can resist if rents do drop a little bit, then you’re, let’s say at the break even part that’s okay with me.

Okay.

I just don’t want to be negative.

Okay.

Dan, do you have a minimum that you do with your investments?

I’m very much more like Corey, I take a holistic view of it and say, okay, for me, when I do my own financial goal and say this is what I want to achieve in 10 years. When I look at the cash flow it’s negligible, right? It’s like a couple hundred bucks for each one.

It’s, it still counts. Don’t get me wrong.

Sure.

But for me, that’s my safety net and my cushion. So if I bought all my properties with, $50 then that cushion’s not very big, right? And so I take a look at it and say I have some income from my regular, job, so I can float it a little bit.

But at the same time, you don’t want 50 property’s just barely squeezing by and then you get a cash call, right? So I think holistically, like Corey said, if I’m buying in a good market, I will sacrifice a little bit of cash flow for that upward trend, right? So I think it’s really Tiffany was saying, you can’t look at one property, you have to look at your whole portfolio. Okay, great.

And for me total ROI and The 4 Ways to Win is important cuz that’s your total ROI. But it’s a great observation that you could have a total ROI of 20%, but a negative cash flow. And does that mean it’s a good return? Probably not cuz we don’t like negative cash flow.

There’s very few situations and there are situations, but there’s very few where you would actually go for a break even or negative cash flow. And I’ll give you the example in a moment.

You should have two minimum numbers. Number one is your cash on cash return. And this is what Tiffany was referring to of how much I put in and how much I get out.

So I bought a property. If I buy a property in the US… I don’t know, $10,000 at auction, I get $200 a month. That’s fantastic. If I buy a $3 million plaza and I get $200 a month, that’s terrible. So how much do I invest and how much do I get back? That’s your cash on cash return, and I like to have 5% cash on cash return.

Now to Cory’s point, if other market demographics are just screaming hot and they look really good, will I accept a four or a three? Yes. So it’s hard to say. I will only accept 5% because of all the other different variables in the deal. And then there’s minimum dollar, absolute dollar. $200 is a nice rule of thumb because if you get $200 but of course it depends on how you, how much you spend on the property, right?

So it’s impossible. I would hate to say $200 is your number. I think about work effort, right? So if something’s a turnkey property it, I’ll probably need less. That doesn’t take any work. I’ll probably need less cash flow a month to be feel good about it than say, a student rental, which I know is going to be more work.

So the property type depends as. But I’ll give the example of the one acre property that I purchased, that I showed you on Friday. I bought the two acre, then I bought the one acre. That one acre property doesn’t cash flow. In fact, the return is good because it’s an expensive property, even appreciating a 3% with the leverage.

But it’s zero or negative. But I’m okay with that because the play for me, there isn’t cash flow. I have other investments that cover the cash flow. I’m not putting myself or my family in a rough situation by buying something that doesn’t pay. And my play there is the development play, and it’s a 20 year play, and I’m okay with that.

So in my calculations, I’m okay with being negative or zero for 20 years, putting in that work and then getting paid out in the future. So those, that’s a situation where I would break every rule that I just gave you with cash on cash return at minimum cash flow

And one thing I’d add to that is really at the end of the day where we make our money in real estate and where it starts to turn into wealth is when the equity has gone up, property values go up over time, and when the mortgages get paid down, that’s really when I’m returning a joint venture partner, a check at the end of 10 years.

The equity appreciation is where we’ve made all our money and the mortgage being paid down, the cash flow is always minimal. Really what the cash flow does is gets you through that process and lets you last through the process long enough where you actually make really good money on the equity appreciation and the mortgage paydown.

So it’s not the cash flow that is gonna make you wealthy it just lets you be in the game long enough.

Okay, cool.

Recent Blogs

The Best Time To “Cash Out” Is…

“When should I ‘cash out’ and sell my properties?” I hear this question a lot and it blows my…

Attract Higher Paying Tenants by Being Pet Friendly!

Optimizing an investment property is all about maximizing your income and minimizing your workload and expenses, such as tenant turnover.…

The 7-Step JV Process

“It’s better to own 10% of 100 properties than 100% of 1 property.” No matter how wealthy and successful…

Income Vs Net Worth

In today’s world, two of the most important financial metrics are income and net worth. Understanding the distinction between the…